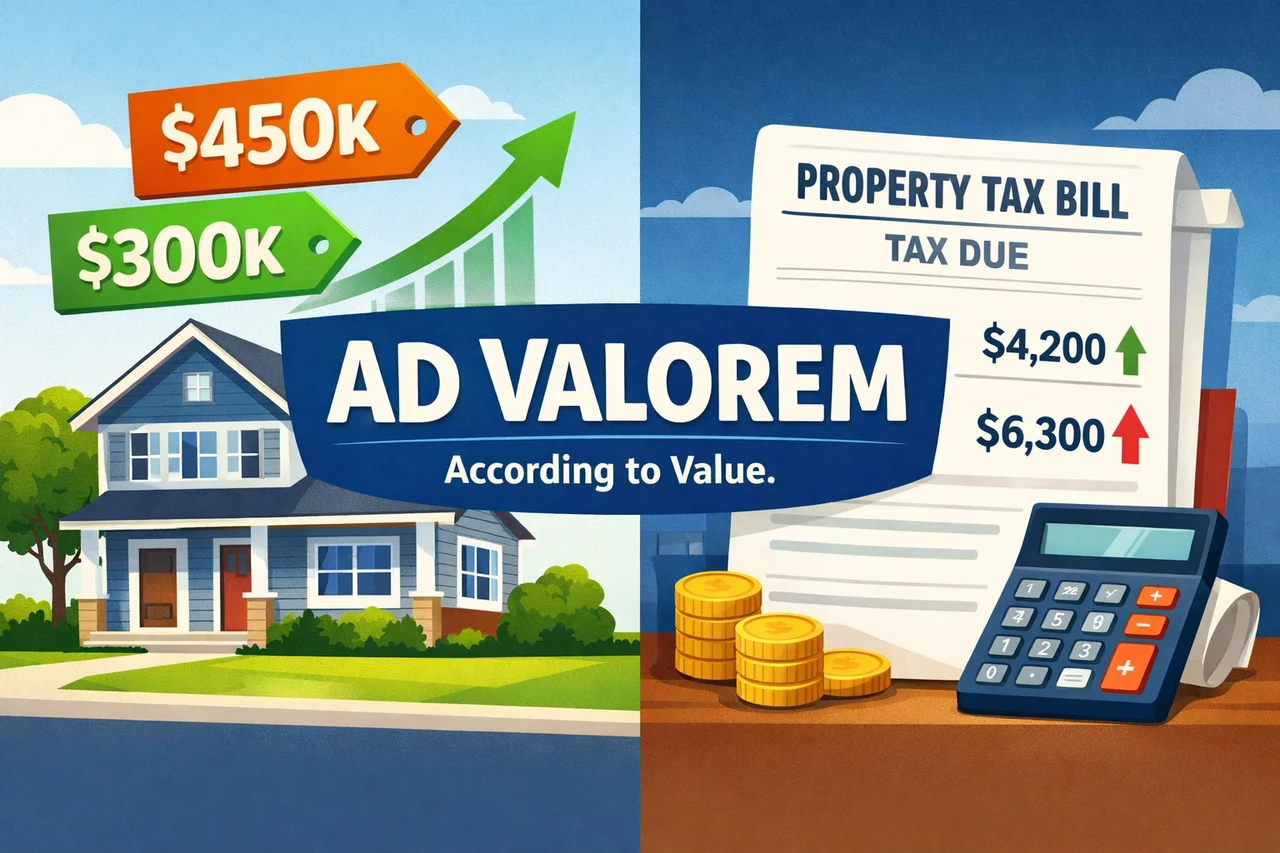

Why Your Property Tax Moves With Your Home's Price: "Ad Valorem" Explained

If your home value goes up and your tax bill goes up too… that's usually not a coincidence.

That relationship has a name: Ad Valorem.

And yes—it's Latin, so it looks scarier than it is.

The 30-Second Definition

Ad valorem literally means "according to value."So an ad valorem tax is a tax that's proportional to the value of the thing being taxed.

In real estate, the most common example is property tax, which is typically based on the assessed/taxable value of real property.

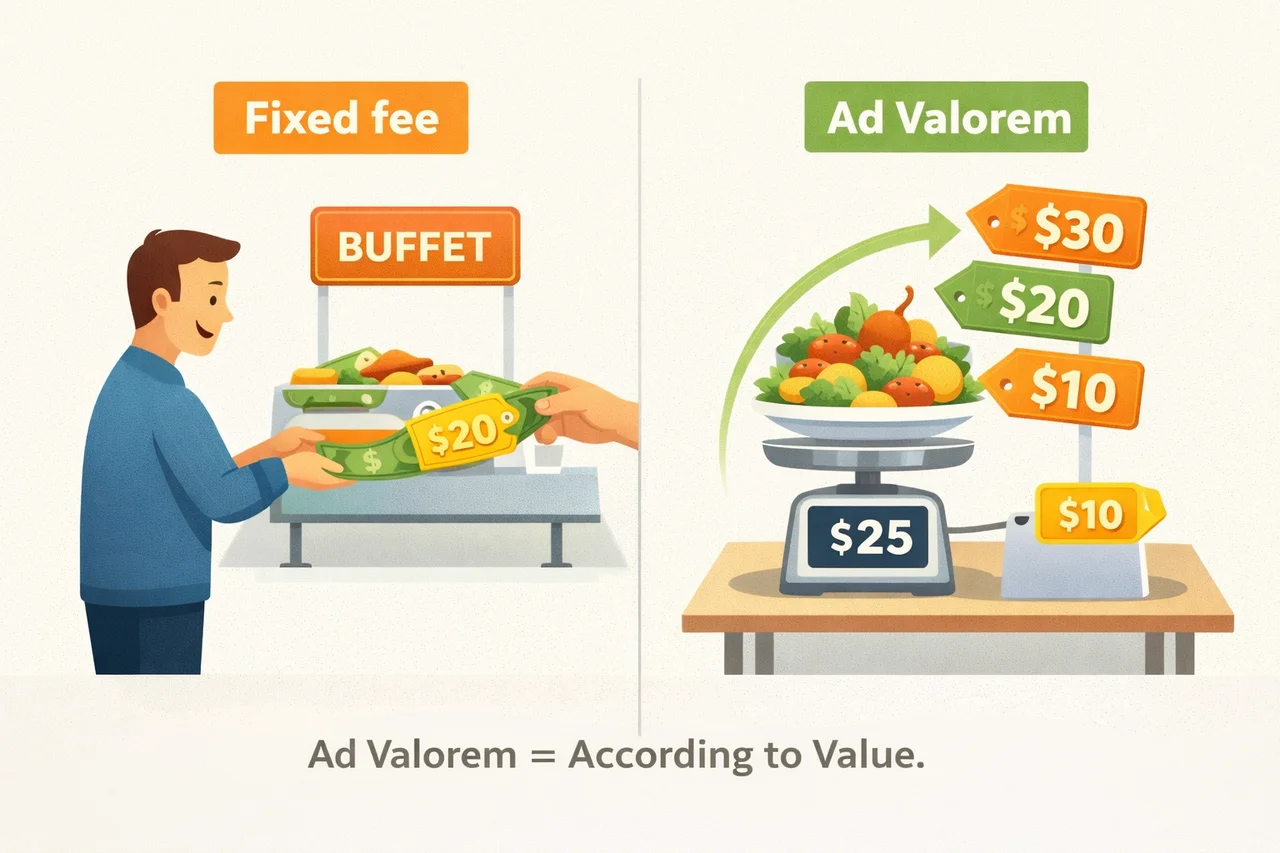

The Analogy You'll Remember: The Buffet

Here's the simplest way to lock this in:

You go to a buffet.

There are two ways they can charge you:

- Fixed price per person (same cost no matter what you eat)

- Price by plate weight (the more you pile on, the more you pay)

More value → more tax. Less value → less tax.

How It Shows Up on a Property Tax Bill

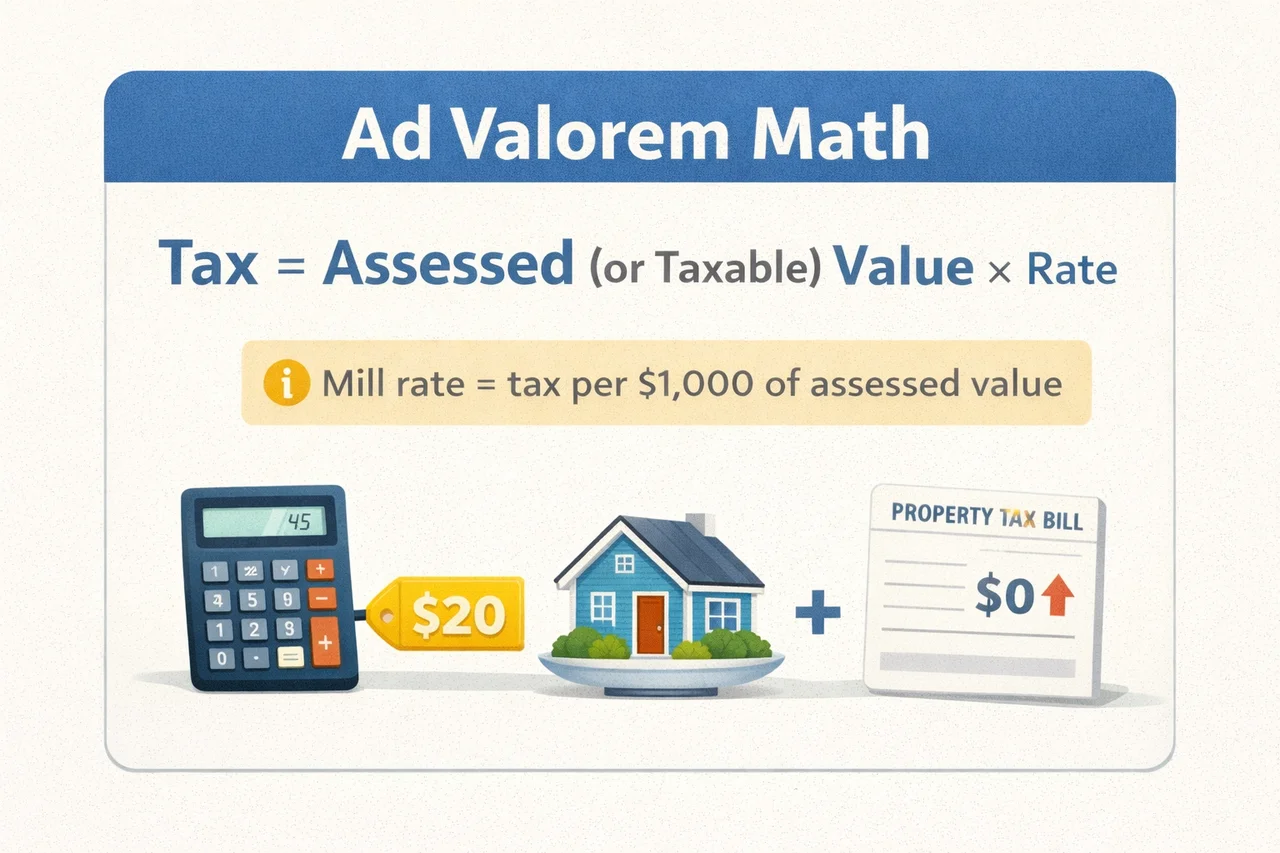

In most property-tax contexts, the logic is:

Taxable/Assessed Value × Tax Rate = Property TaxMany jurisdictions express the tax rate as a mill rate (millage rate)—a tax amount per $1,000 of assessed value.

A common way to compute it is:

Property tax = (Assessed value × Mill rate) ÷ 1,000And as a quick unit reminder:

1 mill = $1 of tax per $1,000 of taxable value.

A Quick Example (So You Can Do This in Your Head)

Let's say your property has an assessed value of $250,000.

And the combined local millage rate is 20 mills (which means $20 per $1,000).

The math:

- $250,000 × 20 = 5,000,000

- 5,000,000 ÷ 1,000 = $5,000

So your property tax would be $5,000 (in this simplified example).

Notice what this teaches you immediately:

If the assessed value rises, the tax rises—even if the "rate" stays the same.The Exam Trap: Ad Valorem vs. "Not Based on Value"

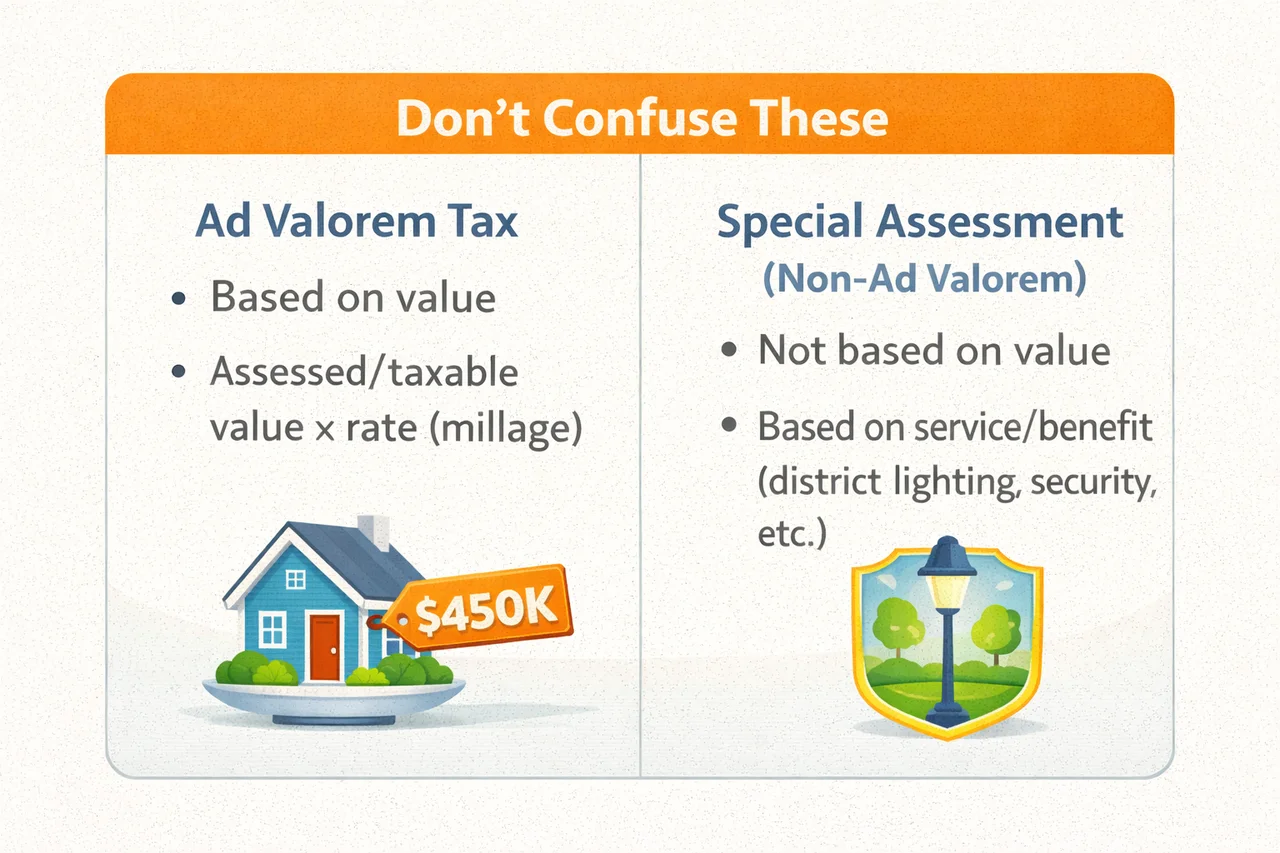

This is where people miss easy points.

Ad Valorem (Value-Based)

Look for phrases like:

- "According to value"

- "Based on assessed value"

- "Millage rate / mills"

- "Property tax"

Non-Ad Valorem Special Assessments (Benefit/Service-Based)

Special assessments are commonly described as not based on property value, but tied to specific services or benefits (lighting, landscaping, district services, etc.).

This contrast shows up directly on real tax bills in some places as "non-ad valorem" lines.

Your Scratch-Paper Cheat Sheet

If you see a question about property taxes and the wording feels "math-y," write this down:

- Ad Valorem = According to Value

- Property tax is commonly ad valorem

- Millage = tax per $1,000 of assessed value

- Special assessment = often non-ad valorem (not value-based)

If the question says "based on value," you already have the answer.

Final Thoughts

Ad valorem sounds like a term you'd only see in an ancient law book.

But it's actually a simple idea you've seen before:

You pay in proportion to value.One question for you (and it's a great self-test):

When you see "special assessment" on an exam question, do you instinctively treat it like a normal property tax—or do you pause and ask, "Is this actually value-based?"

The answer matters—and that's the key to getting ad valorem questions right on your exam.